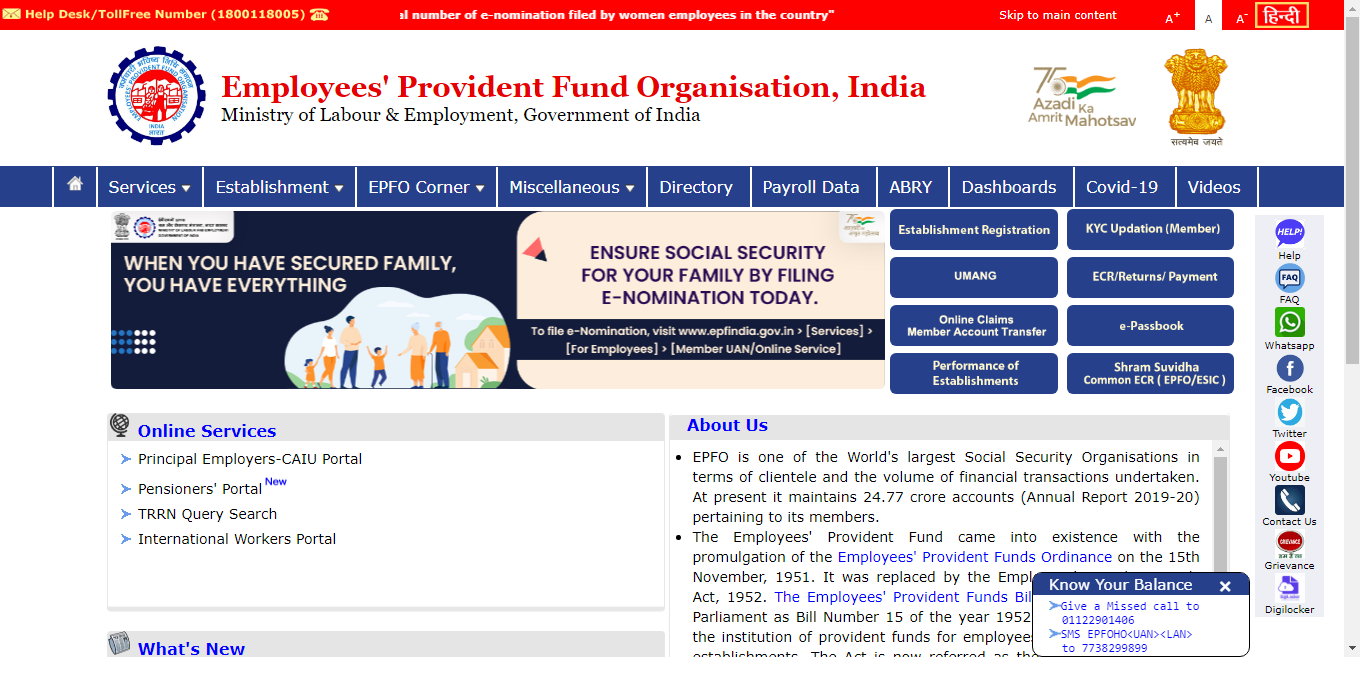

EPFO Unified Portal – epfoindia.gov in – esic.gov.in – P Tax, Vat E Payment – Esic Online Payment: The government of India will be launching an Online portal For Office Workers and Employees of India. The Portal will be known as EPFO Unified Portal. The main use of epfoindia.gov in the portal is all the employees who had left the job will get the various benefits. Here are all the employees who want to check their EPFO online Payment Status can read the below article carefully.

EPFO Unified Portal – ESIC Online Challan Payment [ईपीएफओ लॉगिन]. unifiedportal-mem.epfindia.gov.in/memberinterface EPFO Payment Login UAN No.

unifiedportal-mem.epfindia.gov.in – EPFO Unified Portal

Check EPFO Unified Portal – ESIC Payment: A good personnel finance tool kit need to serve three essential objects. 1st Wealth generation Through Investment Products. 2nd retirement Accumulation via pension plans. 3rd Protection which is best served with insurance policies. Now, this might come as a surprise but most of us are already invested in one such Financial product which addresses all three needs that is wealth, retirement, and protection and this multi dexterous product are non-other than the Provident Employment Fund which is popularly known as the EPF. In today’s article, we are cover all Essential details regarding the EPFO Unified Portal – ESIC Payment.

Latest Update As of 05-November-2021: Employees Provident Fund is very important for all the employees who are working somewhere. EPFO Unified Portal – ESIC Payment will be provided by the government of India for all the citizens of India. By registering on the EPFO Unified Portal ESIC Payment Online, the beneficiaries will get many of the benefits. So all the employees who didn’t want to register in EPFO till now will go and register now. In the below article we are given you the direct link for apply online.

Technical Helpline Number: 18001-18005

Direct Link For Apply: Mention In the Below Article

Overview Regarding the EPFO Unified Portal ESIC Payment Online:

| Name Of the Organization | Employees Provident Fund Organization |

| Conducting Authority | Ministry Of Labour and Employment, Government Of India |

| Category | Common Registration Under (EPFO & ESIC) |

| Post Title | EPFO Unified Portal – ESIC Payment |

| Beneficiaries For | Citizen Of India |

| Total EPFO Registrations | 304501 |

| Total ESIC Registrations | 250858 |

| Scheme Launched By | Government Of India |

| Technical Helpline Number | 18001-18005 |

| Head Office Address | Employees’ Provident Fund Organisation, Bhavishya Nidhi Bhawan, 14, Bhikaiji Cama Place, New Delhi 110066 |

| Official Website |

|

Design of Employees Provident Fund

The EPF is not only one scheme but actually comprises 3 different schemes with 3 different Objectives.

- EPF: The first part of the core of the scheme which is where your retirement benefits are accumulated this is the wealth generation part of the scheme.

- Employee Pension Scheme: The purpose of the EPS is to generate pensions for employees after the age of 58 years.

- Employment Deposit Linked Insurance Scheme: EDLI is a life insurance cover provided to the member.

Note: That one does not register separately for all these three benefits it means when you get registered to EPF you are automatically registered for EPS and EDLI as well.

How Does Employees Provident Fund Work:

On the face of it, the working of the EPF scheme is quite straightforward. The scheme started with the employee paying a certain part of his or her salary toward the scheme which is often matched with an equal contribution from the employer. And this total money taken and deposited with the Employees Provident Fund Organization on which you continue to accumulate the interest every year and that’s its. This is the basic working of the EPF Scheme.

Let’s know more about it, the word Salary for the purpose of the EPF salary means only 2 things that are is your Basic Salary and your DNS Allowance. This means it does not include your HRA your Conveyance Allowance, Special Allowance Or any Other Benefits given in your salary slip.

Eligibility Under the EPFO Scheme

- The present rule requires that any organization with 20 or more employees will have to compulsively register with the EPFO and provide employment with EPF benefits.

- In fact, organizations with less than 20 employees can also join the EPF Programme on a voluntary basis.

- Additionally, the rules also state employees whose salary is up to an INR. 15,000 a month have to necessarily be a part of the EPF Programme.

EPFO Intrest Earned:

The EPF interest rate is Proposed on a yearly basis but the employee’s provident funds the organization central board of trustees which is then sent for the final approval to the ministry of finance. The last declared EPF interest rate was for the year 2019 – 20 which stood at 8.5 per cent. This 8.5 per cent is very interesting because it is probably the largest gap we are seeing when compared to the Public Provident Fund which is at just 7.1 Percent.

Withdrawing Money From EPF:

There are the 3 scenarios upon which 100% of the EPF can be withdrawn:

- Attaining the age of 58 Years

- Unemployed for 2 months or more.

- Death Of Member

Now if you withdraw from your EPF Account without Retirement then there are quite a number of terms and conditions that you need to be fulfilled.

- Education

- Purchase of Land

- Marriage

- Medical Emergency

- Home Loan Repayment etc.

A Most comprehensive list of scenarios is available on the EPFO India Website. We will be providing the link below to this article. Let’s take a couple of examples to illustrate the complexity involved.

- Medical Emergency

1. No minimum Membership period

2. Lower of 100% Contriobutrion or 6 months Salary - Withdrawl for Weeding

1. Minimum 7 Years Of Services

2. Maximum 50 Percent of Contribution.

EPFO Unified Portal – ESIC Payment Helpline Details

- Technical Helpline Number: 18001-18005

- Head Office Address: Employees’ Provident Fund Organisation, Bhavishya Nidhi Bhawan, 14, Bhikaiji Cama Place, New Delhi 110066

Total registration of Labour Laws at Shram Suvidha Portal:

| Particulars | Total Number of Reghsiatrion |

| EPFO | 304501 |

| ESIC | 250858 |

| CLRA | 1712 |

| BOCW | 11493 |

| ISMW | 273 |

| CLRA CLC Licensing | 50140 |

| ISMW CLC Licensing | 2132 |

| LIN Generated | 3343748 |

How To Register in the EPFO Unified Portal – ESIC Payment:

- Firstly users have to go on the official website of EPFO Unified Portal via @unifiedportal-emp.epfindia.gov.in

- Now on the homepage of the official website Click on the “Common Registration Under (EPFO & ESIC)”

- Now you will be redirected to the new login page.

- Click on the Signup

- A registration window will appear you have to fill up the correct details such as the name, email, mobile number, captcha.

- Now the user will get the OTP on the mobile number fill the OTP in the appearing Column and with the click on submit button your account is created.

- Now attach all the required documents and fill in all the asking details and with a click on the submit button you are successfully registered.

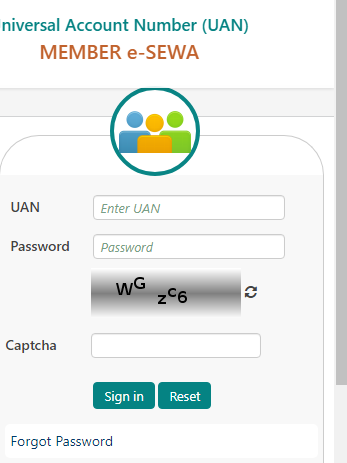

How to EPFO UAN Login | EPFO Unified Portal ESIC Payment Status:

- Start with the visiting of the official website through @unifiedportal-emp.epfindia.gov.in

- Now on the login page logging, you are account with a user ID and Password.

- after login into your account on click on the status, you can check the status of your payments.

Some Important Links:

EPFO Unified Portal Official Website: Click Here

EPFO Online Payment Status – EPFO Unified Portal Login:

The initiative is launched by the government of India which is known as the Employees Provident Fund Organization India. It is popularly known as the EPFO. The beneficiaries of this EPFO Portal are Office Workers and Employees of India. With this portal, the employees will get various benefits such as the saving in their Employees Provident Fund during their job. Employees who are already registered and want to check their EPFO Online Payment Status will have to check online via epfoindia.gov in. Through this article, we are providing the complete information regarding the EPFO, Esic Online Payment, Vat E Payment, EPFO Unified Portal, Documents Required For Register in EPFO, Details Required For Checking the Status, Eligibility Criteria, Benefits, etc.

General Information Regarding the EPFO Member Home Login:

| Name Of Portal | Employees Provident Fund Organization India |

| Well Known as | EPFO |

| Beneficiaries | Office Workers and Employees of India |

| Portal Managed By | Government Of India |

| Use Of EPFO | Due to the Physical incapacitation, all the employees who had left the job will get the various benefits |

| Address | Bhavishya Nidhi Bhawan, 14, Bhikaiji Cama Place, New Delhi – 110 066. |

| Toll-Free Contact Us Number | 1800118005 |

| Name Of Article | EPFO Unified Portal – epfoindia.gov in – esic.gov.in – P Tax, Vat E Payment – Esic Online Payment |

| Mode Of Esic Online Payment | Online Mode |

| Official Website | epfoindia.gov in | esic.gov.in |

You May Also Check:

- EPFO Nominee Registration 2022

- UPP Pay Slip 2022

- rconnect.ril.com Pay SLip

- PSPCL Salary Pay Slip 2022

- AMU Pension Pay Slip

- Dsc Pay Slip

- CRPF Pay Slip

- BSF Pay Slip 2022

- ITBP PIS Pay Slip

- AP Employee Pay Slip

एपफओ वेबसाइट लोगिन – एपफओ यूनिफाइड पोर्टल लॉगिन:

एपफओ पोर्टल भारत सर्कार द्वारा निकला गया एक पोर्टल ह। इस पोर्टल के उपयोग से भारतीय कर्मचारी भविष्य के लिए लाभ उठा सकते ह। इसके अंतर्गत इन्ही के आय का कुछ हिस्सा उनके भविष्य के लिए सुरक्षित किआ जाता ह। जो इनके रिटायर होने पर पफ के तौर पर एम्प्लोयी को दिए जता ह। इसका लाभ भारत के सभी कर्मचारी उठा सकते ह। नीचे दिए गए आर्टिकल से आप एपफओ यूनिफाइड पोर्टल की सभी जानकारी व्हे लॉगिन प्रोसेस जान सकते है|

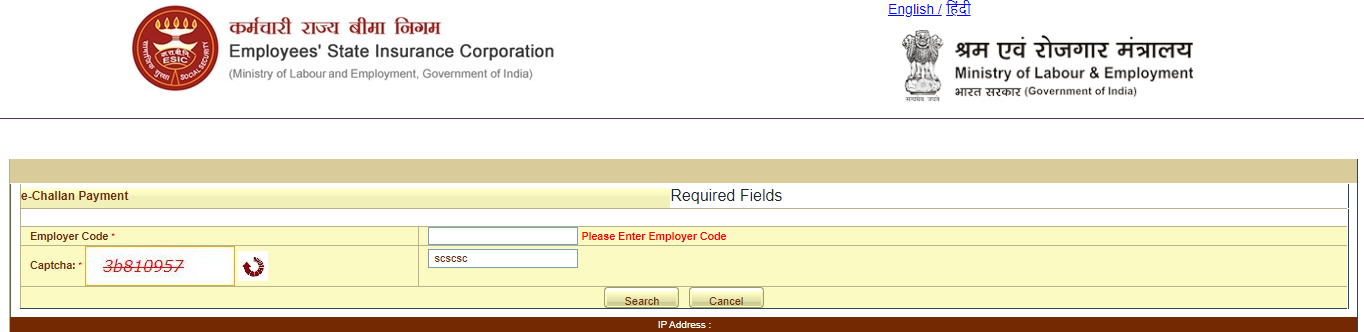

ESIC Online Payment – ESIC Challan Payment:

The Employees’ State Insurance Corporation is well known as the ESIC. The ESIC will come under the Ministry of Labour andy Employment. So the ESIC is also for the benefit of the employees. Under the ESIC if the employee can face sickness, maternity, temporary or permanent disablement it will be all covered under the Employees’ State Insurance Corporation. The ESI Act will be passed in 1948. Employees who want to check their ESIC Challan Payment will check online. For checking the ESIC Online Payment employees will have Employer Code and Captcha.

Services Provided For Employees EPFO Unified Portal:

- EPFiGMS (Register your Grievance)

- Fillable Application Form for COC

- Member Passbook

- Pensioner’s Portal

- One Employee – One EPF Account

- Member UAN/Online Service (OCS/OTCP)

- Know Your Claim Status

Services Provided For Employers epfoindia.gov in Portal:

- EPFiGMS (Register your Grievance)

- For Principal Employers

- Establishment Online Registration

- Online ECR / Challan Submission / OTCP

- Pradhan Mantri Rojgar Protsahan Yojana

- UAN Dashboard

Facilities Available On EPFO esic.gov.in Portal:

- Establishment Services

- EPCO Conor

- Miscellaneous

- Pay Roll Data, etc.

Details Required For EPFO UAN Login:

- UAN Number

- Password

- Captcha

Documents Required For EPFO Unified Portal Registration:

- Aadhar Card

- Driving License

- Pan Card

- Voter ID

- Office Appointment Letter

- Employment Number

- Any Documents Issued by Government

- Passport Size Photo, etc.

Details Required For Esic Online Payment Status Check:

- Employer Code

- Captcha

Benefits Regarding the EPFO Unified Portal:

Employees Provident Fund Organization Benefits:

- Due to the Physical incapacitation, all the employees who had left the job will get the various benefits

Employees’ State Insurance Corporation Benefits:

- Under the ESIC if the employee can face sickness, maternity, temporary or permanent disablement it will be all covered under the Employees’ State Insurance Corporation.

How To Login on epfoindia.gov in EPFO Unified Portal:

- Firstly Employees will have to go on the official website of the Employees Provident Fund via unifiedportal-mem.epfindia.gov.in

- Now on the homepage of the official website Search the MEMBER e-SEWA Login.

- And there in the login column, you have to fill up the required details such as the UAN Number, Password, Captcha.

- After that click on the login button and your EPFO portal will be login.

How To Check ESIC Online Payment:

- First of all the employees will have to go to the official website of Employees’ State Insurance Corporation via @ www.esic.in

- NOw on the homepage of the official website click on the Pay e-challan.

- Again on the appearing window fill up the required details such as Employer Code, Captcha.

- And your e-challan will appear on your display.

Some Important Links :

- EPFO Unified Portal: Click Here

- Employees’ State Insurance Corporation Official Website: Click Here

- ESIC Online Payment Check: Check Here